is new mexico tax friendly for retirees

New Mexico Relative tax burden. New Mexico is moderately tax-friendly toward retirees.

State By State Guide To Taxes On Retirees Kiplinger

Seniors must live to 100 to skip income taxes.

. Compared to many other popular retirement. For seniors 65 or older there is an 8000 deduction on retirement income if the household. Three main types of state taxesincome tax property tax and sales taxinteract to determine the most tax-friendly states if.

Is new mexico tax friendly for retirees Tuesday March 15 2022 Edit. Social Security retirement benefits are taxable in New Mexico but they are also partially deductible. The Garden State taxes at a 249 rate and the average property tax bill is 8362.

The elimination of income tax on Social Security in New Mexico is going to benefit retirees the many children being fostered by their grandparents and New Mexicos middle. There are also no taxes on Social Security benefits pensions or distributions from retirement plans nor are there estate or inheritance taxes. 11 Pros And Cons Of Retiring In New Mexico Retirepedia.

New Mexico is moderately tax-friendly toward retirees. New Mexico is moderately tax-friendly for retirees. Withdrawals from retirement accounts are partially taxed.

Based on property taxes alone New Jersey is the worst state to retire in. New Mexico is moderately tax-friendly for retirees. For seniors age 65 or older there is an 8000 deduction on retirement income if the household adjusted gross income.

Its important to note that New Mexico does tax retirement income including Social Security. New Mexico Retirement Tax Friendliness. By Benjamin Yates August 15 2022 August 15 2022.

Wages are taxed at. New Mexico is moderately tax-friendly toward retirees. New Mexico is moderately tax-friendly for retirees.

Well explain what makes a state tax-friendly which states are the most tax-friendly for retirees and touch on the importance of property tax relief. For seniors 65 or. Does new mexico offer a tax break to retirees.

New Mexico is one of only nine states that gives a big unnecessary tax break. Social Security income is partially taxed. Social Security retirement benefits are taxable in New Mexico but they are also partially deductible.

The exemption is 2500 for taxpayers. Does New Mexico Have A Capital Gains Tax. Social Security income is partially taxedWages are taxed at normal rates and your marginal state tax rate is 590.

Then below the map link to more content about state taxes on retirees including our picks for the 10 most tax-friendly opens in new tab and the 10 least tax-friendly states for. A 1 tax on interest and dividends has been. The Cost of Living Is Low.

New Mexico is well known for its low costing of living which is 31 lower than the average in the United States. Depending on income level taxpayers 65 years of age or older may be eligible for a deduction from taxable income of up to. Does New Mexico offer a tax break to retirees.

However many lower-income seniors can qualify for a deduction that reduces.

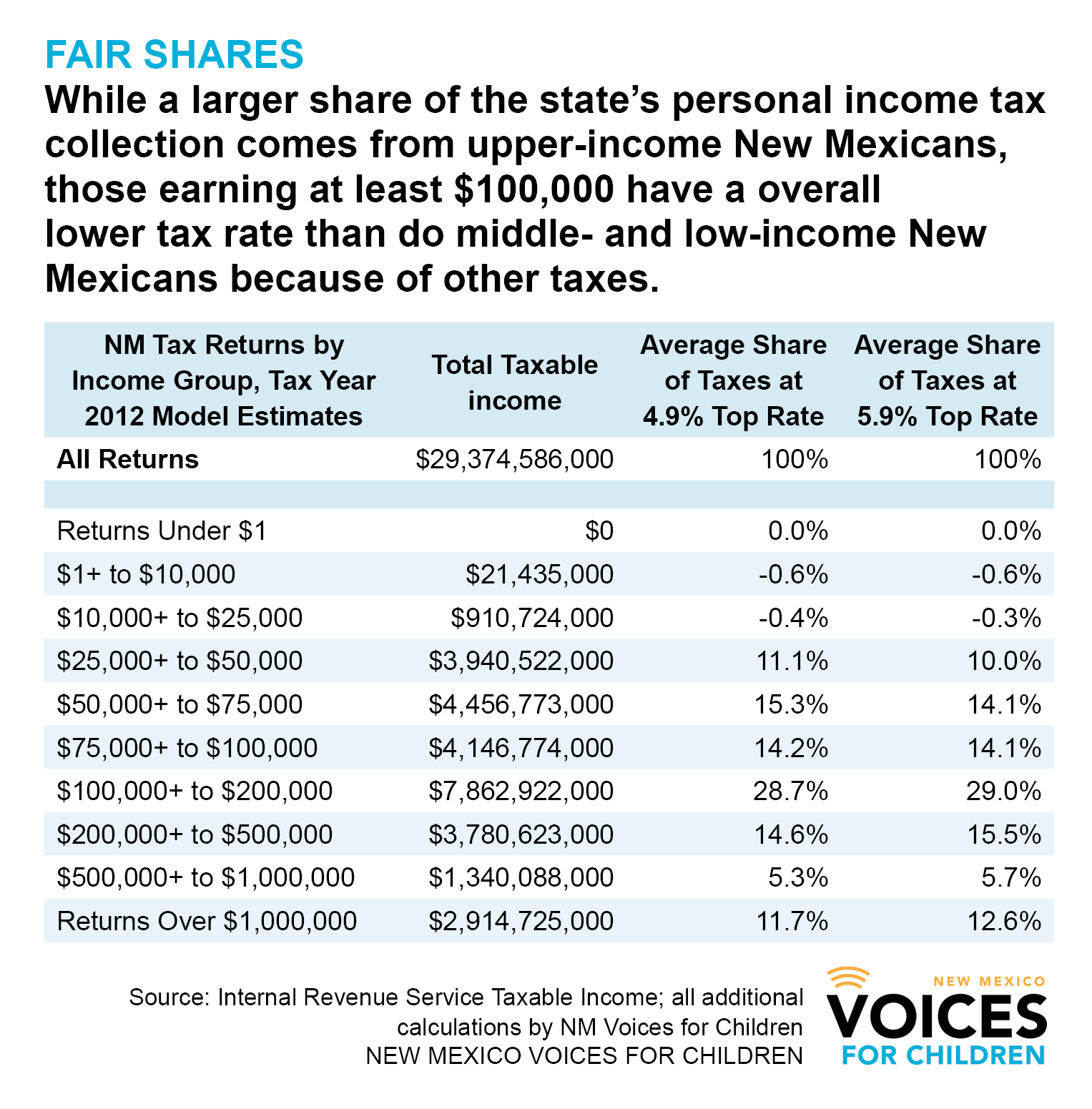

Why The Poor Pay The Highest Tax Rate In New Mexico And One Step Toward A Fix New Mexico Voices For Children

States That Don T Tax Social Security

The 10 Least Tax Friendly States For Military Retirees Kiplinger

The 10 Best Places To Retire In New Mexico In 2021 Newhomesource

The Best States To Retire In According To Taxes Slideshow The Active Times

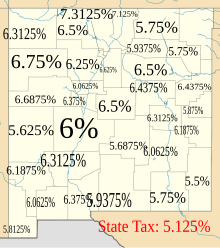

Taxation In New Mexico Wikipedia

Taxes In Retirement How All 50 States Tax Retirees Kiplinger

6 Pros And Cons Of Retiring In New Mexico 2020 Aging Greatly

12 Of The Cheapest States To Retire Due

New Mexico Retirement Tax Friendliness Smartasset

The 10 Best Places To Retire In New Mexico In 2021 Newhomesource

The Most Tax Friendly U S State For Retirees Isn T What You D Guess And Neither Is The Least Tax Friendly Marketwatch

Taxes In Retirement How All 50 States Tax Retirees Kiplinger

New Mexico Lands On List Of Worst States To Retire To Albuquerque Business First

Moneywise Kansas 3rd Worst State For Taxing Retirees Kansas Policy Institute

States That Don T Tax Retirement Income Personal Capital